The system is rigged against you. This is a legal reality for every injury victim in Texas. In 2003, the Texas Legislature passed House Bill 4, a pivotal tort reform measure that placed strict caps on damages and fundamentally altered civil litigation.

These legislative caps drastically changed how our San Antonio truck accident lawyers act to secure justice. Because statutory limits now cap ‘pain and suffering’ awards, we must aggressively pursue ‘Gross Negligence’ claims to pierce the corporate shield—especially in cases involving wrongful death lawsuits where families are left with nothing but limited insurance offers.

San Antonio Tort Reform Litigation: Trial Lawyer Takeaways

- As your San Antonio personal injury lawyer, we fight insurance adjusters who weaponize tort reform to deny your family fair compensation.

- We protect victims injured on corridors like Loop 410 in San Antonio by proving Gross Negligence to pierce corporate shields.

- Trevino Injury Law leverages 80+ jury trials to defeat Colossus algorithms designed to minimize your settlement offer.

- We bypass the Paid vs. Incurred rule by proving uncapped Future Medical Expenses under Texas law to maximize recovery.

Do You Qualify For Full Compensation?

“The insurance company offered less than $20,000. I ended up with over a million.” – Jackie Galindo

While politicians claimed a “lawsuit crisis,” the data reveals a safety crisis. A 2016 Johns Hopkins study identified medical errors as the third leading cause of death in the U.S., claiming over 250,000 lives annually. Despite this danger, a Harvard Medical Practice Study found that fewer than 3% of negligence victims ever file a claim.

For families in San Antonio and Bexar County, this restrictive landscape shifts the burden from negligent defendants to you. Insurance adjusters weaponize these statutes to devalue your medical treatment and limit financial compensation. You need a San Antonio personal injury lawyer who understands the exceptions to these caps.

At Trevino Injury Law, we have taken 80+ cases to trial to force insurance giants to pay what is fair, not just what the legislature suggests. We fight to prove gross negligence and secure justice. Do not accept their evaluation as final; your right to trial is your strongest weapon.

Call 210-Trevino for a free case review. Se Habla Español.

The History of Tort Reform: How HB 4 Changed Personal Injury Law

The Reform Act rewrote Texas law in 2003 by implementing comprehensive litigation reform and liability protections. The act established new rules that prioritized protecting physicians in Texas and health care providers from lawsuits over the rights of injured citizens. While publicly focused on doctors, the bill also targeted mass tort cases, including asbestos litigation, by creating a specific multidistrict litigation panel to divert cases away from local state courts.

This legislative overhaul fundamentally changed the civil justice system, introducing strict caps on damages and new evidentiary standards that continue to impact every personal injury case filed in the Bexar County Courthouse today.

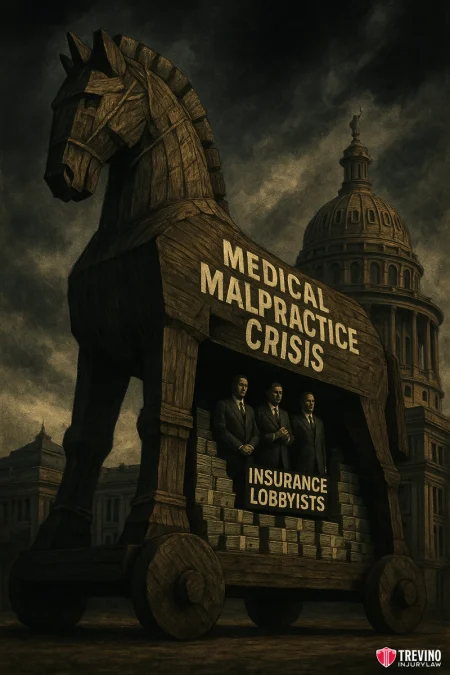

In the late 1990s and early 2000s, groups like the American Medical Association and Texas physicians claimed the state was facing a “medical malpractice crisis” that was preventing doctors from moving to Texas. However, historical data suggests this narrative was driven by the rising cost of medical malpractice insurance rather than an explosion of lawsuits.

The reforms were devastatingly effective at discouraging valid claims; according to an analysis of Texas Department of Insurance (TDI) data, the frequency of medical malpractice claims dropped by nearly two-thirds between 2003 and 2011.

We recognize that this manufactured crisis was used to justify broad legal changes that now protect negligent trucking companies and property owners just as fiercely as they protect surgeons. The true intent was to shift financial liability away from corporate defendants, leaving injured families to bear the economic burden of their recovery.

The Hidden Truth: “Hard Markets” vs. Frivolous Lawsuits

To truly understand why your rights were stripped away in 2003, you must look beyond the political slogans to the Texas economic reality. The “crisis” that prompted the Civil Justice Reform coincided with a “hard market”—a period where liability insurance premiums skyrocket for the policyholder. This was driven by the insurance industry’s investment losses, not by a sudden spike in jury verdicts, as falling interest rates and poor investment returns by insurance carriers typically cause.

During a hard market, insurance companies raise premiums to offset their investment losses, but in 2003, lobbyists successfully framed these rate hikes as the fault of “runaway juries”. Data from the National Practitioner Data Bank later revealed that the number of medical malpractice payments had actually remained stable during the supposed crisis.

Yet, the reform brought massive profits to insurers at the expense of victims. TDI-based analysis shows that for one large Texas carrier, average liability premiums for physicians fell by approximately 46% between 2003 and 2011, proving that the “crisis” was solved on the backs of injured patients. By anchoring the legislative changes to a temporary economic cycle, the Texas Legislature cemented permanent restrictions on your rights. This means that today, even though insurance profits have soared and the “crisis” has long passed, you are still bound by emergency-era restrictions designed to solve a financial problem that no longer exists.

The Role of Texans for Lawsuit Reform (TLR)

Texans for Lawsuit Reform (TLR) played the decisive role in lobbying for reforming the civil justice system. They organized a massive campaign to label the so-called “lawsuit industry” as a drain on the citizens of Texas. Governor Perry and TLR successfully altered public perception, creating a stigma around legal services that defense attorneys still exploit during jury selection in South Texas courts today.

Their efforts ensured that the legislative changes were not just procedural, but cultural, making it harder for a San Antonio jury to award fair damages without feeling they are part of the problem.

Proposition 12: Amending the Constitution to Limit Your Rights

Proposition 12 was a constitutional amendment presented to Texas voters in September 2003 specifically to grant the legislature the power to cap non-economic damages, a restriction that was previously unenforceable under the Texas Constitution’s Open Courts Provision.

Before this amendment, the judiciary, including the state’s highest appellate court, consistently ruled that arbitrary damage caps were unconstitutional. In the landmark decision of Lucas v. United States, 757 S.W.2d 687 (Tex. 1988), the Court held that it was “unreasonable and arbitrary” to limit a catastrophic injury victim’s recovery merely to lower insurance costs.

To bypass this judicial protection, proponents pushed Proposition 12, effectively overturning Lucas and granting politicians in Austin the authority to decide the maximum value of a child’s pain or a parent’s disfigurement, regardless of the specific facts heard by a jury in a courtroom.

The Legacy of 2003: From Medical Malpractice to Trucking

The legacy of 2003 extends far beyond medical malpractice, as the principles established in HB 4 set a precedent for “tort reform creep” that emboldened insurance carriers in commercial trucking and general liability sectors to aggressively deny valid claims.

While the original push focused on doctors, the legislation also tightened court jurisdiction rules to prevent what corporations called “forum shopping.” Today, the climate signals to trucking companies that Texas is a “business-friendly” venue. This environment encourages aggressive defense tactics to increase the time and expense of litigation for victims. In all injury cases, from slip-and-falls at North Star Mall to catastrophic collisions in the Eagle Ford Shale.

The danger is real and growing; according to 2023 TxDOT data, Texas roads saw over 4,200 fatalities in a single year, highlighting the massive disconnect between increasing danger and decreasing corporate accountability.

The “Frivolous” Stigma: Overcoming Jury Bias

The most lasting damage of the 2003 reforms wasn’t just the caps; it was the psychological conditioning of Texas jurors. The massive PR campaigns of that era successfully branded injury victims as “opportunists” and plaintiffs’ lawyers as “greedy.”

This created a hurdle known as the “skepticism barrier.” Today, when you walk into a San Antonio courtroom, many jurors are predisposed to believe your injury is exaggerated before they hear a single fact. We combat this by confronting the bias head-on during Voir Dire (jury selection).

We don’t hide from the “frivolous lawsuit” narrative; we expose it. By showing the jury that approximately 97% of civil cases end in settlement or dismissal before trial, we demonstrate that your case is a serious, individual matter, not a frivolous claim or a generic class action, and if it makes it to their courtroom, it is the exception, serious, substantiated, and unresolved because the insurance company refuses to be fair.

We shift the narrative from “Plaintiff vs. Defendant” to “Community Safety vs. Corporate Negligence,” reminding jurors that their verdict sets the safety standard for the roads their own families drive on.

The Math of Injustice: How Damage Caps Actually Work

Damage caps work by imposing a strict statutory cap on non-economic damages that limits the amount of financial compensation a judge can award, regardless of the jury’s verdict or the severity of the victim’s suffering. Whether your case is capped at $250,000 depends entirely on the specific defendant type (e.g., a doctor versus a commercial truck driver) and the category of damages (tangible medical bills versus intangible pain).

Many victims in San Antonio wrongly assume that every injury case faces this hard limit. In reality, the $250,000 cap primarily targets medical malpractice claims under Chapter 74 of the Texas Civil Practice and Remedies Code. For general personal injury cases, such as a wreck caused by a distracted driver on Loop 1604 or a workplace injury in Live Oak, economic damages for medical costs and lost wages remain uncapped.

However, insurance adjusters frequently exploit this confusion, implying to unrepresented families that “state law” prevents them from offering more, hoping you will accept a lowball settlement without challenging their math.

Damage Cap Breakdown

| Damage Type | Legal Definition | Is It Capped? | Trevino Strategy |

| Economic Damages | Objective financial losses: Past and future medical bills, lost wages, loss of earning capacity. | NO CAP. You are entitled to 100% of these proven losses in general injury cases. | We use Certified Life Care Planners to maximize this “uncapped” bucket. |

| Non-Economic Damages | Subjective losses: Physical pain, mental anguish, physical impairment, disfigurement. | CAPPED (In Med Mal). Limited to $250k per provider, up to $750k aggregate. | We use “Day in the Life” videos to make these damages undeniable to a jury. |

| Punitive Damages | Exemplary damages designed to punish the defendant for bad behavior. | CAPPED. Generally limited to 2x Economic Damages + $750,000. | We prove “Gross Negligence” to trigger these additional payouts. |

The “Jury Blindfold” Rule: Why You Can’t Tell the Jury About Caps

The “Jury Blindfold” rule forbids attorneys from informing jurors that the judge will automatically reduce any damages they award for pain and suffering to meet statutory caps after the trial concludes.

Imagine a trial in San Antonio. The jury hears weeks of testimony about a paralyzed child. They decide that $5 million is the fair compensation for a lifetime of suffering. They write “$5,000,000” on the verdict form, believing they have done justice.

The Blindfold: Once the jury leaves the room, the judge is legally required to slash that award down to the statutory cap. The jury’s decision is rendered symbolic. The insurance company’s assets are protected from the community’s true valuation.

Breaking Down the $250,000 Non-Economic Cap

The $250,000 non-economic cap specifically limits compensation for subjective losses like physical pain, mental anguish, disfigurement, and loss of consortium, distinct from objective costs like hospital bills. In medical malpractice cases, this cap involves a “stacking” rule: you can recover up to $250,000 from a physician and up to $250,000 from each of up to two healthcare institutions, creating a theoretical maximum aggregate of $750,000.

This complex structure makes identifying every potentially liable party, from the nursing staff to the hospital administration, a critical strategy for maximizing recovery within the system’s constraints.

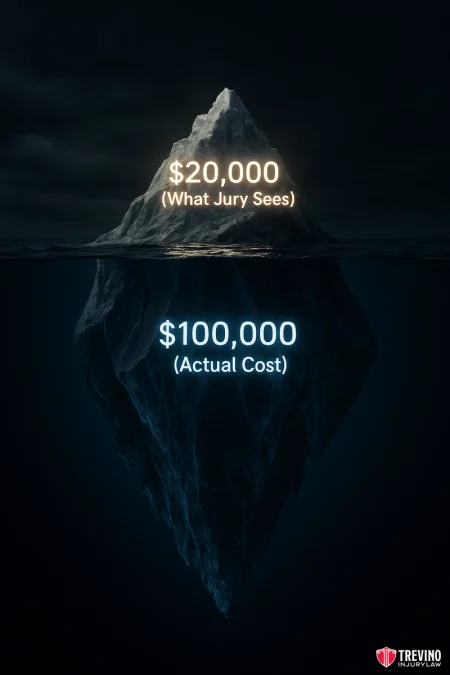

The “Paid vs. Incurred” Trap (The Invisible Cap)

The “Paid vs. Incurred” rule limits the medical expenses you can present to a jury to the amount actually paid by insurance or accepted as payment in full, rather than the full amount billed by the hospital.

For example, if University Hospital bills $100,000 for emergency surgery but your health insurance settles the debt for $20,000, Texas law allows the jury to see only the $20,000 figure. This makes a catastrophic injury look like a minor fender bender on paper. If a jury sees only $20,000 in bills, they are less likely to award significant pain and suffering damages, artificially suppressing the value of your entire case.

The “Future Medical” Loophole: How We Bypass the Write-Offs

While the law allows insurance companies to slash the value of your past medical bills (the “paid vs. incurred” trap), it has a critical blind spot: Future Medical Expenses.

Texas law does not allow the defense to apply insurance write-offs to medical care you haven’t received yet. This is the battlefield where we win back the value of your case.

If you have a spinal injury from an 18-wheeler crash, we don’t just look at your emergency room bill. We hire Certified Life Care Planners to create a roadmap of your needs for the next 20, 30, or 40 years. A $50,000 past medical claim might be reduced to $15,000 by the judge, but a $500,000 future care plan goes to the jury untouched. This strategy shifts the focus from “reimbursing bills” to “securing your future,” legally bypassing the artificial limits designed to suppress your recovery.

The “Trial Authority” Strategy: How We Pierce the Corporate Shield

We pierce the corporate shield by shifting the legal battleground from simple negligence, which is often capped, to gross negligence and punitive damages, which require a higher standard of proof but unlock far greater compensation potential. To win against capped damages, we must prove that the defendant didn’t just make a mistake, but acted with a conscious indifference to the extreme risk they posed to your family.

This strategy requires a “Trial Authority” mindset that most settlement-focused firms lack. While they look for the quickest exit, we meticulously investigate the root causes of the incident. In a trucking case, this means looking beyond the crash site on I-10 to the company’s hiring practices and safety logs. By demonstrating that a corporation prioritized profit over safety, we open legal pathways that bypass standard insurance limitations.

The “Gross Negligence” Exception: Unlocking Punitive Damages

The gross negligence exception allows victims to recover exemplary damages if they meet the rigorous standard established in Transportation Insurance Co. v. Moriel, 879 S.W.2d 10 (Tex. 1994). Under Moriel, we must prove two distinct elements: objectively, that the act involved an extreme degree of risk, and subjectively, that the defendant had actual awareness of that risk but proceeded with conscious indifference.

Meeting this high bar is the only legal mechanism to ‘pierce the shield’ of standard liability caps. Proving this ‘Gross Negligence’ exception is the primary legal strategy we use in commercial vehicle accident litigation to bypass those standard caps. Proving this requires digging deep into corporate records to find “smoking gun” evidence, such as ignored maintenance warnings or coerced driving logs. Successfully triggering this exception raises the cap ceiling significantly, up to two times the amount of economic damages plus $750,000 in non-economic damages, punishing the wrongdoer in a way that standard liability cannot.

The “Black Box” Revelation: Proving They Knew

Proving “Gross Negligence” requires showing the company knew about the danger. We don’t find this evidence in police reports; we find it in the Electronic Control Modules (ECMs) and Telematics Data.

Modern commercial trucks are rolling computers that record every hard brake, sudden acceleration, and speed event. We act immediately to preserve this data, often revealing:

- The driver was speeding 15 mph over the limit on I-10.

- The driver ignored federal “Hours of Service” rest breaks.

- The company received 50+ alerts about the driver’s recklessness and deleted them.

This is the “smoking gun.” When we show a jury that a safety director received 50+ speed alerts and deleted them instead of disciplining the driver, the case shifts from a “traffic accident” to “corporate malice.” This specific type of data proof is what triggers the uncapped punitive damages that force insurance companies to settle for maximum value.

The “Bifurcated Trial” Process: A Strategic Advantage

A bifurcated trial splits the case into two separate phases: a first phase to determine liability and standard damages, and a second phase dedicated exclusively to determining the defendant’s net worth and punitive damages.

This procedural move is a powerful tactical advantage because corporate defendants are terrified of the second phase, where their full financial wealth is revealed to the jury. The threat of having their ledger opened often forces insurance companies to offer settlements well above standard caps to resolve the case before the second phase ever begins.

The Stowers Doctrine: Forcing Insurance to Pay Above Policy Limits

The Stowers Doctrine allows us to force an insurance company to pay the entire jury verdict, even if it exceeds the policy limits, when they unreasonably reject a settlement offer that was within those limits.

- We build a case that is clearly worth more than the insurance policy (e.g., a $2 million case on a $1 million policy).

- We send a formal “Stowers Demand” offering to settle for the $1 million limit.

- If they say “No” and we go to trial and win $2 million, the insurance company was negligent in protecting their driver.

- They are now liable for the entire $2 million verdict, even though the policy was only $1 million.

This high-stakes leverage only works if the defense believes your attorney is actually capable of securing a massive verdict at the Bexar County Courthouse.

Inside the Insurance Defense Playbook: How Insurers Weaponize Tort Reform

In Texas, insurance carriers weaponize tort reform by exploiting the law’s complexity to confuse unrepresented victims, often misrepresenting specific statutes to justify lowball offers or outright denials of liability. An insurance adjuster will likely tell you that “Texas law” caps your recovery at a set amount, implying that the $250,000 medical malpractice limit applies to your car accident or slip and fall case when it absolutely does not.

These tactics are designed to make you feel powerless and desperate to accept whatever they offer. Whether dealing with a claim from a collision in Alamo Heights or a workplace accident in the Medical Center, adjusters are trained to exploit your lack of legal knowledge. They know that without a trial lawyer shielding you, they can weaponize statutes intended for doctors to protect trucking companies and retail giants.

Our team includes professionals with over 20 years of insurance defense experience, meaning we know their playbook inside and out and can intercept these plays before they damage your case.

The “Blanket Cap” Deception

The “Blanket Cap” deception occurs when adjusters intentionally blur the lines between different types of injury claims, suggesting that the strict caps of Chapter 74 apply to general negligence cases. This is a calculated lie used to lower your expectations; in reality, a drunk driving crash or a defectively manufactured product carries entirely different liability rules with much higher (or no) caps on economic damages.

They bank on you accepting their “authority” on the law rather than consulting a lawyer who knows the difference between a hospital’s liability and a drunk driver’s negligence.

Weaponizing the “Paid vs. Incurred” Rule via Algorithm

Insurance companies weaponize the “Paid vs. Incurred” rule by using claims adjustment software to automatically strip value from your medical bills based on reimbursement rates before a human ever reviews your file. These algorithms treat your customized medical care as data points, aggressively applying the “paid” reduction to minimize the calculated settlement offer.

We counter this by using expert economists to project your future medical needs, which are not subject to these “paid” limitations because they haven’t happened yet and therefore haven’t been discounted.

Man vs. Machine: Beating the “Colossus” Algorithm

If you received an initial settlement offer that felt insulting, it likely wasn’t calculated by a human. Most major insurance carriers now use software like Colossus or Decision Point to evaluate claims. These programs are designed to strip the human element out of your suffering, reducing your pain to a series of “severity codes.”

The trap is in the documentation. If your medical records don’t contain specific keywords, like “muscle spasm,” “radiating pain,” or “anxiety”, the software assigns “0 points” to your suffering. The result is a lowball offer based on “severity codes,” not your actual life.

We beat the machine. We know the keywords the algorithm is looking for. We work with your doctors to ensure your medical records accurately reflect the intensity of your pain. We flood the adjuster with non-algorithmic evidence, photos, videos, and witness statements, that force a human supervisor to override the computer’s low offer.

The “Delay to Repose” Strategy

The “Delay to Repose” strategy involves dragging out negotiations and information requests to push your claim closer to the Statute of Limitations or the Statute of Repose, hard deadlines that permanently extinguish your right to sue. They may act friendly and claim they are “still investigating” while the clock ticks down on the two-year deadline for most personal injury cases.

Once that date passes, no amount of evidence can save your claim, which is why immediate legal intervention is critical to preserving your rights.

Why They Fear “Voir Dire” More Than the Law

Insurers fear “Voir Dire,” or jury selection, more than the law itself because it is the one stage where a skilled trial lawyer can expose potential juror bias and inoculate the panel against the “frivolous lawsuit” narrative. While they can hide behind statutes and caps in paperwork, they cannot hide from a fair jury of San Antonio citizens who understand the difference between a cash grab and a family’s destruction.

This fear of an unbiased community judgment is often the primary driver that forces them to settle for fair value. Their tactics are formidable, but a single critical question often determines whether these strategies succeed or fail in your specific case.

What Rights Do I Retain Despite Texas Tort Reform Limits?

You retain the constitutional right to a jury trial, full recovery for economic damages like medical bills and lost wages which remain uncapped in most general injury cases, and the ability to seek exemplary damages when gross negligence is proven.

While the 2003 legislation imposed severe restrictions on non-economic compensation for pain and suffering, it did not repeal the Texas Constitution’s Open Courts Provision, meaning the courthouse doors remain open to victims who are prepared to fight for their day in court. Navigating the post-2003 legal landscape in San Antonio requires understanding that your rights are not extinguished, but they are more heavily regulated.

For families dealing with catastrophic injuries from a truck wreck on Loop 410 or a workplace disaster in Converse, the law still allows for significant financial recovery provided you can navigate the procedural hurdles. The system is designed to discourage you from filing suit by making the process expensive and complex, but a trial-ready legal strategy can still secure the resources necessary for long-term care and rehabilitation.

What Is the Difference Between the Statute of Limitations and Statute of Repose?

The Statute of Limitations is a procedural deadline that typically gives you two years from the date of the injury to file a lawsuit, whereas the Statute of Repose is a strict absolute deadline that cuts off your right to sue after a specific period (often 10 to 15 years for products), regardless of when you discovered the harm.

In San Antonio, this distinction is critical for victims of defective products or latent injuries who may not realize the extent of the damage until years later. While the limitations period can sometimes be paused (“tolled”) for minors or incapacitated victims, the Statute of Repose is generally unforgiving, serving as a final bar to litigation to protect manufacturers and builders from indefinite liability.

What Rights Do I Retain After 2025?

You retain the fundamental right to a jury trial and the ability to pursue uncapped economic damages for all tangible financial losses, ensuring full compensation for actual expenses regardless of legislative changes. While other areas of law may face restrictions, the legislature has preserved your authority to sue for every dollar of past and future medical bills and lost wages without statutory limits.

Can I Sue a Government Hospital?

Yes, you can sue a government hospital like University Health, but the Texas Tort Claims Act imposes much stricter limits, often capping damages at $100,000 per person, and requires you to provide formal notice within six months.

Is Texas Tort Reform Retroactive?

No, the laws passed in 2003 generally apply only to claims filed or accruing after the effective date of September 1, 2003, meaning older cases were adjudicated under the previous, less restrictive rules.

What Happens Without Legal Representation in a Capped Case?

Without a trial lawyer to invoke complex exceptions like gross negligence or the Stowers Doctrine, insurance adjusters will strictly enforce the lowest possible caps and aggressively apply “paid vs. incurred” reductions to devalue your claim. A study of outcomes in Bexar County reveals that unrepresented victims rarely successfully challenge the “blanket cap” assertions made by defense teams, often accepting settlements that fail to cover future medical costs.

The absence of a “Constitutional Defender” allows the insurance company to define the terms of your recovery based on their profit models rather than your actual losses, leaving you with no leverage to demand fair compensation for pain and suffering.

What If I Miss the Filing Deadline for My Injury Claim?

If you miss the filing deadline established by the Statute of Limitations, your claim is permanently barred, and you legally lose the right to seek any compensation from the negligent party, no matter how severe your injuries are. The court system effectively closes its doors to your case the moment the clock runs out, granting the insurance company total immunity from liability. This failure to act within the prescribed window is one of the few errors in civil law that is usually irreversible.

Defeat the Caps: Contact Trevino Injury Law Now

Insurance adjusters weaponize Texas tort reform against you. They use “statutory caps” and “paid vs. incurred” algorithms to strip your claim’s value. They count on you hiring a “settlement mill” that will fold early and accept their lowball offers. We do not fold. We are The Trial Authority. We expose “gross negligence” to pierce these corporate shields and force them to pay for your future, not just your past bills.

We prove our power in the Bexar County Courthouse. In Mario Trevino Mendoza v. Farmers Best International, the defense offered $1.3 million. We refused to settle. We fought in court and won a $7.9 Million jury verdict, over six times their best offer.

Call 210-TREVINO for a free, confidential consultation or visit our San Antonio office. Se Habla Español. We work on a strict No Win, No Fee basis.