The Insurance Playbook is a systematic strategy used by insurance defense adjusters and Colossus software in Texas to minimize personal injury claim payouts by artificially lowering settlement values, shifting liability under the 51% Rule, and using administrative delays to force premature settlements from injured victims.

Defeating the “Insurance Defense Playbook”: Key Strategic Takeaways

- As your San Antonio bad faith insurance lawyer, we defeat algorithmic denials on corridors like Loop 410 in Bexar County to demand full value.

- We leverage the Eggshell Plaintiff Doctrine to ensure insurers pay for aggravated injuries rather than deny valid claims due to pre-existing conditions.

- Trevino Injury Law exposed the driver’s negligence to secure the maximum policy limits for client Roland Cardenas despite aggressive liability disputes.

- Our litigators file lawsuits to bypass Colossus software restrictions and force insurance adjusters to prioritize human suffering over data points.

Do You Qualify For Full Compensation?

“The insurance company offered less than $20,000. I ended up with over a million.” – Jackie Galindo

Instead of evaluating your pain and suffering as a unique human experience, these corporate giants use algorithms to convert your injuries into data points, systematically reducing the financial compensation.

When you receive a lowball offer or a denial letter, it is rarely an accident; it is a calculated move derived from thousands of algorithmic data points. Our San Antonio bad faith lawyers recognize these specific tactics from “severity code” omissions to “pre-existing condition” defenses.

This page exposes the specific mechanisms insurers use against you: how Colossus software calculates your pain, how the modified comparative negligence rule is weaponized to deny liability, and why “soft tissue” injuries are systematically undervalued.

You will discover how adjusters use police report errors to shift blame, why they demand years of past medical records, and the specific laws that protect you from these bad faith practices.

If you suspect you are being played by an insurance adjuster using these delay and deny tactics, call 210-TREVINO today. Se Habla Español.

Beating the Algorithm: How Colossus Software Undervalues Your Claim

Colossus software calculates settlement offers by converting your medical records into “severity points” and applying a regional multiplier that often ignores human factors like pain and suffering.

Most major insurance carriers operating in San Antonio, including those with significant corporate presences such as USAA and State Farm, use claims assessment software such as Colossus, ISO Claims Partners, or Claims Outcome Advisor. These programs are not designed to be objective; they are tuned to save the insurer money.

When an adjuster inputs data from your accident on Loop 410 or Bandera Road, the software scans for specific keywords and medical codes. If your doctor’s notes are vague or if you delayed treatment at University Hospital, the software assigns a lower value or zero value to your claim elements. Consequently, most adjusters are bound by the software’s strict range and lack the authority to negotiate significantly without new, compelling evidence.

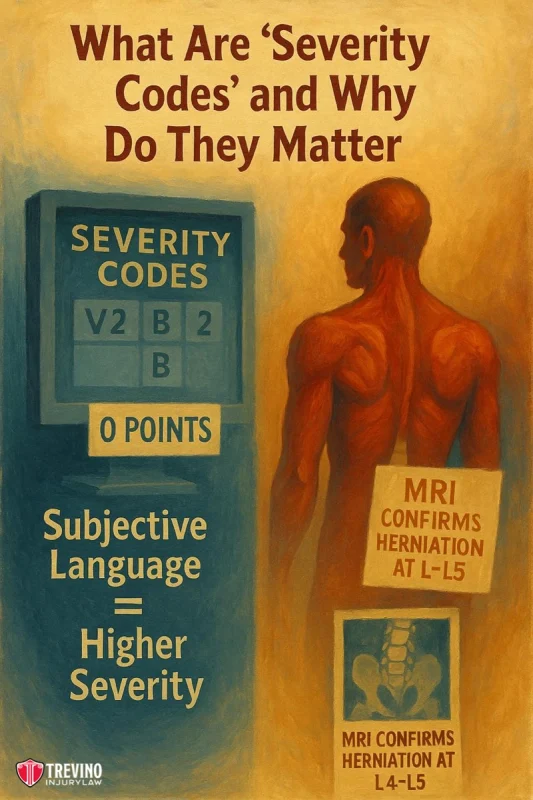

What Are “Severity Codes” and Why Do They Matter?

Severity codes are specific alphanumeric classifications used by claims software to value injuries, where “demonstrable” injuries, such as fractures, receive high points. In contrast, “non-demonstrable” injuries, such as sprains, often receive zero points unless supported by specific medical documentation.

The difference between a fair offer and a lowball denial often comes down to the specific language in your medical records. If a doctor writes “patient reports pain” (subjective), the software may assign it a low severity code. However, if the doctor documents “muscle spasm observed on palpation” or “MRI confirms herniation at L4-L5” (objective), the software assigns higher severity points.

In the South Texas Medical Center area, we work with medical experts who understand the importance of precise documentation. Without these specific “value drivers” in your records, the software will automatically devalue your claim, regardless of how much pain you are actually experiencing.

Can You Negotiate with an Algorithm?

You cannot “argue” with the software; you must feed it new data or force a human review by submitting a Stowers Demand that threatens litigation exceeding policy limits.

Trying to argue on the basis of logic or emotion with an adjuster who Colossus restricts is often futile. To beat the software, you must feed it new data or bypass it entirely. This usually requires a formal legal strategy, such as filing a lawsuit, which removes the claim from the standard adjustment process and places it in the hands of defense attorneys who must evaluate the risk of a jury verdict. In Bexar County, juries are not bound by software algorithms.

A trial-ready attorney uses this leverage to force the insurance company to abandon their computer model and evaluate the real human cost of your injuries.

Since the software relies entirely on specific data inputs to calculate value, we must next examine what happens when those inputs are manipulated to shift the blame entirely onto you.

The 51% Rule: How Insurers Weaponize Modified Comparative Negligence

Under Texas’s Modified Comparative Negligence standard, you are barred from recovering any damages if a court or jury finds you to be 51% or more responsible for the accident.

Insurers aggressively use this rule to deny claims in San Antonio, knowing that a finding of 51% fault saves them 100% of the payout. If they can manipulate the facts of a crash at the “Mixing Bowl” downtown to make it appear that you were speeding or changed lanes unsafely, they can push your fault percentage from 0% to 51%.

This is why you will often see adjusters fighting liability even in clear rear-end collisions or disputes involving commercial vehicles on I-35. They are not just arguing about who caused the crash; they are trying to reach that magic 51% threshold to close their file without writing a check.

Case Examples Proving How We Defeat Liability Defenses

We defeat liability defenses by securing objective evidence, such as dash-cam footage and “black box” data, that proves our client’s innocence, as demonstrated in cases where we turned denied claims into maximum policy limit settlements.

Insurance companies frequently deny responsibility until they are forced to face the evidence. For example, in a case involving a client named Roland Cardenas, the 18-wheeler driver tried to claim our client was speeding and that the crash was his fault.

The insurance company used this to justify a denial. However, we investigated the crash, secured the necessary evidence, and proved the truck driver’s negligence. As Roland noted, “The case settled about one year after the crash for close to the maximum amount available.” Similarly, for Jesus M., despite clear dashcam evidence, the insurer denied responsibility until we intervened to secure maximum compensation.

These results show that liability denials are often just negotiating tactics, not the final word.

What Happens When the Police Report Is Wrong?

While police reports are important, they are generally considered inadmissible hearsay in Texas civil courts, meaning an officer’s initial fault determination is not the final verdict. It can be overturned with proper accident reconstruction evidence.

It is common for police reports to contain errors, especially in chaotic scenes on busy roads like Culebra Road or Loop 1604. An overworked officer may check the wrong box or take a statement only from the uninjured driver while you are being transported to North Central Baptist Hospital. Just because an officer checked a box doesn’t mean it’s the final verdict. We routinely work to correct these reports or use forensic data to prove the officer’s initial assessment was factually incorrect, stripping the insurer of its primary defense.

Liability is one defense, but medical history is another; once they fail to blame you for the crash, they will try to blame your body using the “pre-existing condition” tactic.

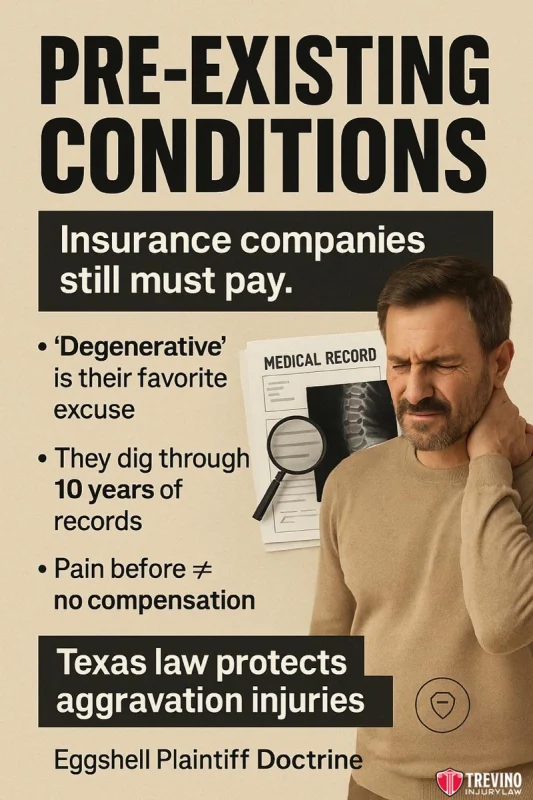

Can Insurance Companies Deny Claims for Pre-Existing Conditions?

Insurers often try to deny claims by labeling crash injuries as “degenerative” or “pre-existing,” but Texas law protects victims through the Eggshell Plaintiff Doctrine.

A favorite tactic of adjusters in South Texas is to request 10 years of your medical records. They are hunting for any mention of “back pain,” “neck stiffness,” or prior injuries. If you complained of back pain to your doctor in Alamo Heights five years ago, they will argue that your current herniated disc from a truck crash is just “degenerative disc disease” and not their responsibility.

This is standard procedure for spine and joint injuries. They attempt to confuse the issue, hoping you will accept a nuisance value settlement rather than fight for the full coverage required to treat the aggravation of your condition.

Insurance companies often use a variety of tactics during the claims process to protect their bottom line. An insurance company may try to deny your claim or argue that you were partially at fault, hoping to reduce the value of your claim. Some insurers delay or mishandle insurance claims, forcing victims to file a complaint or seek legal advice just to receive what they are owed.

Experienced attorneys help level the playing field, ensuring insurers cannot exploit technicalities or use pre-existing conditions to deny or devalue your claim. With the proper legal representation, victims can hold these companies accountable and secure fair compensation for the extent of their injuries.

The Eggshell Plaintiff Doctrine: Forcing Payouts for Pre-Existing Conditions

The Eggshell Plaintiff Doctrine is a fundamental legal principle in Texas stating that a defendant ‘takes the victim as they find them.’ As affirmed in $Coates v. Whittington$, 758 S.W.2d 749 (Tex. 1988), a negligent party cannot escape liability simply because a victim was more susceptible to injury due to a pre-existing condition.

This precedent serves as your legal shield, establishing that the insurer is financially responsible for any aggravation or worsening of a prior injury caused by the crash, regardless of your medical history.

Even if you had a fragile back or a previous sports injury from years ago, a negligent driver on US-281 does not get a “free pass” because you were not in perfect health. If the accident made a manageable condition unbearable or required new surgery, the insurer is liable for those new damages.

We use this doctrine to force insurers to pay for the difference between your health before the crash and your condition after it, ensuring you aren’t penalized for your medical history.

Why Do Insurers Deny “Soft Tissue” Injuries?

Insurers deny “soft tissue” injuries like whiplash or sprains by using the “MIST” (Minor Impact Soft Tissue) protocol, which automatically caps settlement offers at low amounts regardless of the victim’s actual pain or disability.

Adjusters often dismiss soft tissue injuries as “minor,” but we know that severe whiplash or ligament damage can be debilitating. In San Antonio, where rear-end collisions are frequent on congested arteries like San Pedro Avenue, adjusters will often look at photos of minor bumper damage and immediately classify the claim as MIST. They argue that “low property damage equals no injury.”

This is a scientific fallacy. We fight this by connecting the medical reality of your injury, documented by specialists, to the functional limitations it causes in your daily life, proving that “soft tissue” does not mean “soft damages.”

These denial tactics are frustrating, but delay tactics are often illegal; knowing when they cross the line lets you turn their stalling against them.

Why Do Insurance Companies Use “Delay, Deny, Defend” Tactics?

The “Delay, Deny, Defend” strategy is designed to exploit a victim’s financial desperation, forcing them to accept a low settlement rather than wait for a fair trial.

Insurance companies are financial institutions; they make money by holding onto premiums for as long as possible. In San Antonio, we frequently see stalling tactics such as requesting the same medical release forms twice, switching adjusters mid-claim, or claiming they “lost” paperwork.

For a family in Converse or Kirby facing mounting medical bills and lost wages, these delays are devastating. The insurer knows that every month they delay is another month you are under pressure to cave. They are betting that you will break before they do.

What Are the Signs of Bad Faith Stalling?

Common signs of bad-faith stalling include failing to confirm coverage within 15 days, failing to pay within 5 days of the agreement, and offering significantly less than the claim’s obvious value.

You should be alert to “red flags” that indicate an adjuster is acting in bad faith rather than just being slow. If an adjuster from a primary carrier ignores your calls for weeks, offers a settlement that is a fraction of your medical bills without explanation, or misrepresents the policy coverage, they are likely violating their duty of good faith.

In Texas, insurance practices are regulated, and these behaviors are not just annoying; they are actionable. Recognizing these tactics early allows us to document the file and prepare for potential extra-contractual damages.

Texas Insurance Code Chapter 542: Using Deadlines as a Sword

es, Texas Insurance Code Chapter 542 sets strict deadlines for insurers: they must acknowledge a claim within 15 days and pay it within five business days of notifying you of acceptance.

If an insurance company misses these deadlines, it faces strict penalties under the Prompt Payment of Claims Act (Texas Insurance Code Chapter 542). As clarified by the Texas Supreme Court in $Lamar Homes, Inc. v. Mid-Continent Casualty Co., 242 S.W.3d 1 (Tex. 2007)$, this statute is designed to penalize insurers for delays, making them liable for the claim amount, attorney’s fees, and an 18% statutory interest penalty.

We use this statutory leverage to cut through administrative delays and force adjusters to prioritize your file.

We use Chapter 542 as a sword to cut through the delays and force adjusters to move your file to the top of the stack.

Knowing these laws empowers you, but knowing how to transition from knowing your rights to taking action is the key to defeating the playbook.

How Can You Fight Back Against These Insurance Defense Tactics?

Fighting back requires documenting every interaction to build a paper trail, formally rejecting lowball offers with a well-reasoned counter-demand, and filing a lawsuit when bad faith is evident to remove the adjuster’s control over the timeline.

The entire insurance business model is predicated on the assumption that you will eventually give up. They bank on your frustration. However, hiring a bad-faith lawyer changes the equation instantly. It introduces a variable that Colossus cannot calculate: the risk of a jury verdict.

When we file a lawsuit in Bexar County, the case moves from an adjuster’s cubicle to a courtroom where real people, not algorithms, decide what your pain is worth. This shifts the leverage back to you, forcing the insurer to pay fair value to avoid the uncertainty and expense of a trial.

Before you act on this leverage, you must ensure you understand the specific procedural steps and legal rights that govern your ability to sue.

What Steps Should You Take If Your Claim Is Denied?

Immediately request a written explanation for the denial, gather new evidence to refute their specific reason, and consult with an attorney to draft a formal demand letter that forces a reconsideration.

A denial is not the end of the road; it is often just the opening position of a negotiation. First, force them to put it in writing; Texas law requires them to explain why they are denying coverage. Once you have the specific reason, whether they are claiming you were at fault or that the policy lapsed, you can target that particular lie with evidence.

If they claim you weren’t hurt, provide the MRI report from Mission Trail Baptist Hospital. If they claim their driver wasn’t at fault, give the witness statement. A systematic appeal, backed by a San Antonio injury lawyer, turns their vague denial into a specific legal dispute they must resolve.

Do I Need a Formal Denial Letter to Sue?

Yes, you typically need a written denial or a final “take it or leave it” offer to trigger the statute of limitations and prove bad faith in court.Bad faith in court.

Can I Record Calls with the Insurance Adjuster in Texas?

Yes, Texas is a “one-party consent” state, meaning you can legally record your conversations with the adjuster without their permission to preserve evidence of their statements.

Does the Insurance Company Have to Reveal Policy Limits?

No, generally, insurers in Texas are not required to disclose policy limits pre-litigation unless specific conditions are met, often forcing you to file suit to find out the truth.

While taking these steps protects your procedural rights, understanding who, or what, is actually evaluating your claim helps you combat the low value they initially assign.

Human Adjuster vs. Software Evaluation: What’s the Difference?

A human adjuster may consider subjective factors such as witness credibility and jury appeal. At the same time, software evaluations rely solely on data-entry codes and statistical averages to generate a value range.

The adjuster you speak to on the phone often hides behind the software, saying, “The computer only authorized $5,000.” This is a deflection. A human adjuster has the authority to override the software, but they rarely do so unless they fear a lawsuit.

The software sees a “back sprain” code; a human jury in Bexar County considers a father in Helotes who can no longer pick up his children. Our job is to force the insurance carrier to step away from the computer screen and look at the human reality of your loss.

Knowing the difference helps you negotiate, but knowing the permanent cost of accepting their initial “software-generated” offer is critical for your financial future.

What Happens If You Accept the First Settlement Offer?

Accepting the first offer typically requires signing a “Release of Liability,” which permanently bars you from seeking more money even if your injuries worsen or require future surgery.

Insurers often target families in rural areas like Somerset or Von Ormy with quick cash offers immediately after a crash. This is the “settlement mill” trap. That $2,500 check might cover your ambulance ride, but it won’t cover the surgery you might need six months later. The first offer is almost always the “Colossus floor,” the absolute minimum the software thinks you might take to go away.

By accepting it, you are selling your rights for pennies on the dollar and leaving your family unprotected against future medical costs.

Accepting too early is dangerous because it closes your case forever, but waiting too long to file a dispute is equally fatal due to strict legal time limits.

When Is It Too Late to Dispute a Claim Denial?

In Texas, you generally have two years from the date of the accident (or the bad faith act) to file a lawsuit, after which your claim is permanently void.

This legal deadline is called the Statute of Limitations. It is unforgiving. If you are negotiating with an adjuster and the second anniversary of your crash passes, they will stop returning your calls immediately because they no longer have to pay you a dime.

Negotiating does not pause the clock. Whether you are in China Grove or downtown San Antonio, if you miss this deadline, the courthouse doors are locked to you forever. We ensure a lawsuit is filed well before this expiration date to preserve your right to fight.

Why Hire a San Antonio Insurance Bad Faith Attorney?

Software algorithms cannot measure the pain of a father in Helotes unable to hold his children, but a Bexar County jury can. While insurance giants hide behind “severity codes” to deny valid claims, we expose their bad-faith tactics. Settlement mills often accept the computer’s first lowball offer; we file suit to break it and force them to face the risk of a verdict.

We routinely defeat these tactics, just as we turned a denied claim for client Roland Cardenas into a maximum policy limit settlement by proving negligence despite the insurer’s initial defense. You need a San Antonio insurance bad faith attorney to submit a formal Stowers Demand that bypasses the algorithm and triggers a mandatory human review.

Call 210-TREVINO for a free case review. Se Habla Español. We fight on a contingency basis: No Win, No Fee.